Quick links

goods and services tax

DCHP-2 (May 2012)

Spelling variants:GST

n. — Finance, Administration

a federal value-added tax applied to most goods and services.

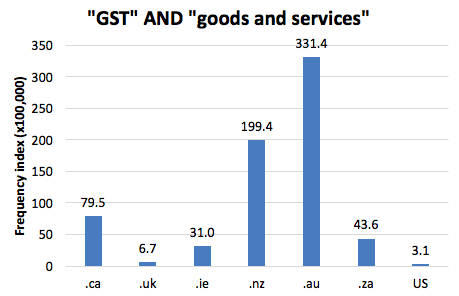

Type: 3. Semantic Change — The term was first used in New Zealand in the mid 1980s, after which Canada followed suit with its own version of the tax in 1991 (see the 1989 quotation), with the exception of the province of Quebec, where the roughly equivalent but independently administered QST was introduced. Set by the federal government, the Canadian goods and services tax was first applied at a rate of 7%, but has since been reduced, in two steps (see the 2006 and 2008 quotations) to a rate of 5% since 1 Jan. 2008. As Chart 1 shows, the term is still most widely used in New Zealand and Australia, although in the North American context, Canada obviously stands out.

See also COD-2, s.v. "goods and services tax", which labels the term "Cdn & NZ".

See also COD-2, s.v. "goods and services tax", which labels the term "Cdn & NZ".

The initialism GST is much more commonly used than the full phrase.

Quotations

1985

Recently, the Government's attention has turned to the tax system. It has already announced its plan for a fringe benefits tax and it recently released a white paper on its proposed goods and services tax.

1986

Charges quoted are expected to rise 10 per cent Oct. 1 when the New Zealand government introduces a new goods and services tax, which will be added to all prices within the country.

1989

That doesn't include the inflationary pressures from the introduction of the nine-per-cent goods and services tax that is to be brought in Jan. 1, 1991.

1991

The goods and services tax goes into effect today, adding 7 per cent to the price of everything from haircuts to funerals.

And it will cause "chaos, total pandemonium" in the marketplace, predicts Don Eastcott, managing director of the Edmonton-based Canadian Organization of Small Business.

The GST is expected to add about $15 to the weekly budget of an average family of four. But getting used to the tax is not going to be easy, Eastcott said.

1999

Hard to believe it's been almost a decade since the still controversial goods and services tax was dropped into consumers' laps.

2006

The first Tory budget last spring cut the federal goods-and-services tax by a percentage point starting July 1.

2008

And when the federal government lowered its goods and services tax by one percentage point on Jan. 1, Charest rejected a PQ proposal to raise the provincial sales tax.

2015

FIFE [to Bill Morneau]: Okay, and I know you're also, one of the first steps when parliament comes is back to bring in the middle class tax cuts and roll back the Tory tax measures. We also learned this week, though, from the parliamentary budget officer you may be running a larger deficit than you had predicted and you'll have a better idea when you get to look at the books comprehensively. So you need money and a lot of people are saying why don't you just jack up the GST by one percent?

References

- COD-2

Images